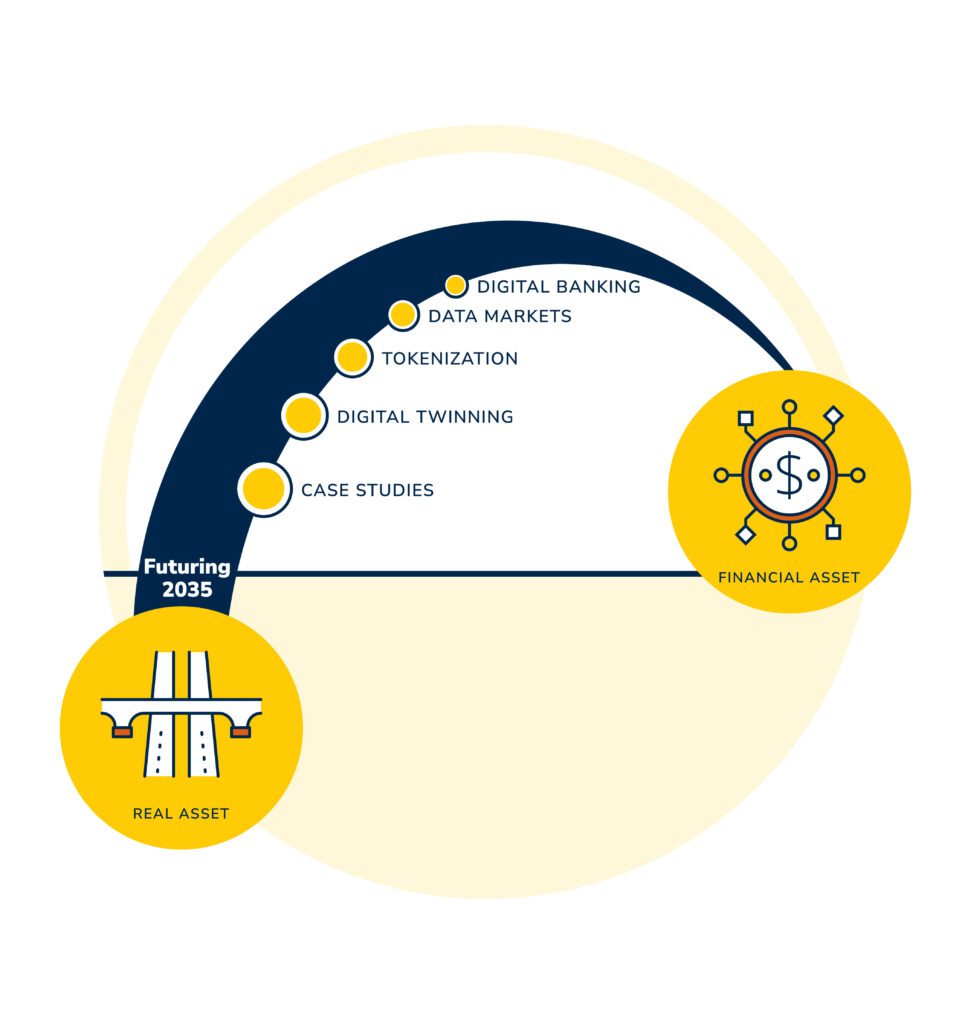

Digital Financing and Business Models for Smart Infrastructure Assets

Efficient Financing for Intelligent Infrastructure

The Center for Digital Asset Finance (CDAF) at the University of Michigan (U-M) integrates digital twins of smart infrastructure with financial innovations such as fintech to solve financing problems for critical societal infrastructure services such as energy, water, transportation and housing, along with digital infrastructures such as networks and communications services.

CDAF specifically focuses on integrating Internet of Things (IoT) enabled data-streams from water, transportation, housing, energy and waste systems with financial models.

We seek to address investment barriers such as cost of financing, market adoption and cost performance uncertainties.

Learn More

Megatrends Drive Motivation

Digital delivery of infrastructure assets and services

Exploring how financial technologies enable next generation affordable infrastructure delivery

Master of Engineering in Smart Infrastructure Finance

In 2023, the Master of Engineering (MEng) degree in Smart Infrastructure Finance will be a highly immersive academic experience that is open to students from different academic backgrounds. The program not only provides a curriculum oriented towards data-driven finance and business models, but also offers students invaluable professional experience in the financial services, data management, and smart infrastructure industries.